In the ever-evolving landscape of Middle Eastern finance, Qatar is making a calculated and ambitious move to redefine its economic identity. Traditionally known for its wealth and dominance in natural gas, this Gulf state is now directing its financial resources toward a venture capital and startup ecosystem.

The shift is timely and strategic, as regional neighbors like the UAE and Saudi Arabia continue to attract the lion’s share of tech attention in the MENA region. Yet, Qatar is positioning itself as a strong contender by blending government-backed support with significant investments.

Money Talks: $3.5 Billion to Boost the Ecosystem

Central to Qatar’s transformation is its Qatar National Vision 2030 — a comprehensive strategy to reduce its dependency on hydrocarbons and build a knowledge-based economy. Qatar’s goal is clear: to become a hub for technology, entrepreneurship, and venture capital.

According to the latest report by Blank Ventures, Qatar has pledged a $3.5 billion to strengthen its startup ecosystem over the next few years. This includes significant allocations for venture capital, entrepreneurship development, and tech infrastructure. Notably, the Qatar Investment Authority (QIA) launched a $1 billion initiative to invest in disruptive technologies worldwide. The country’s strategic focus is also reflected in its establishment of the Qatar FinTech Hub and a regulatory sandbox by the Qatar Central Bank, accelerating the growth of the fintech sector, which is projected to grow at a compound annual growth rate (CAGR) of 15% over the next five years.

Additionally, the Qatar Science & Technology Park (QSTP), part of the Qatar Foundation, has become a central hub for tech innovation, housing over 50 startups and multinational corporations. In 2023, QSTP launched the Tech Venture Fund, a $100 million targeting early-stage tech companies in sectors such as AI, fintech, and clean energy.

The successful hosting of the FIFA World Cup 2022 not only showcased Qatar’s ability to execute large-scale international events but also led to investments in technology and infrastructure that have long-term benefits for the startup ecosystem. Moreover, Web Summit, one of the world’s largest technology conferences, is set to make its second appear in Doha in February 2025, marking its expansion into the Middle East.

Qatar’s push into the global startup arena is underpinned by regulatory reforms aimed at enhancing the country’s attractiveness to foreign investors. The 2019 Foreign Investment Law, which permits up to 100% foreign ownership in most sectors, marks a major shift from previous regulations. Complementing these efforts, the Qatar Free Zones Authority (QFZA) has established business-friendly free zones offering tax exemptions, reducing barriers to entry for international ventures.

Challenges on the Path to Success

However, Qatar’s journey to becoming a startup powerhouse is not without its hurdles. The country’s relatively small population of 2.8 million limits its immediate consumer base, pushing startups to target regional or global markets from the outset.

Regulatory processes, while improving, can still be cumbersome for entrepreneurs navigating complex licensing procedures. Talent acquisition remains another critical challenge. Despite world-class educational institutions, competition from established tech hubs like Dubai can lead to a talent drain, complicating efforts to build a sustainable innovation workforce.

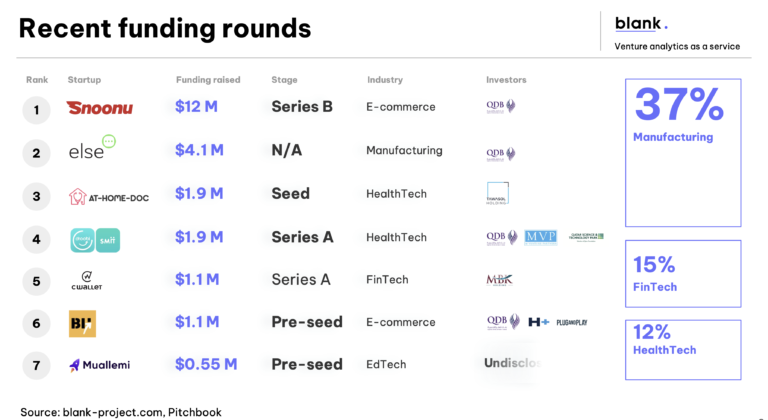

Similar to its GCC partners, Qatar aims to broaden its economic base, yet it trails behind Saudi Arabia in diversifying its economy (with oil and gas accounting for 50% of Qatar’s GDP) and investing in cutting-edge economic sectors. For instance, 37% of venture capital is allocated to the Industrial & Manufacturing sector, with Fintech and Healthtech following as the second and third most favored areas for capital investment, respectively.

These successes reflect a broader trend: according to data from Blank, Qatar has experienced a 3x increase in investment volume since 2020. However, the total investment amount remains relatively small ($34 million in 2023 and $87 million in 2022). This is expected to change significantly between 2024 and 2027, as the fund of funds plans to invest over $1 billion into new startups.

What’s next?

Moving forward, Qatar’s focus on sustainability and innovation is poised to pay dividends. With its National Artificial Intelligence Strategy and investments in renewable energy projects, such as the Al Kharsaah Solar Plant, Qatar is charting a course that integrates economic growth with environmental responsibility.

For startups and venture capitalists looking for a dynamic and evolving market, Qatar’s burgeoning ecosystem offers a compelling proposition. As the country continues to implement reforms, invest in infrastructure, and cultivate international partnerships, it is set to emerge as a key player not just in the MENA region, but on the global stage.

With billions already committed and more expected to flow into the sector, Qatar’s bold leap into venture capital is not just a strategic pivot—it’s a statement of intent. And the world is starting to take notice.