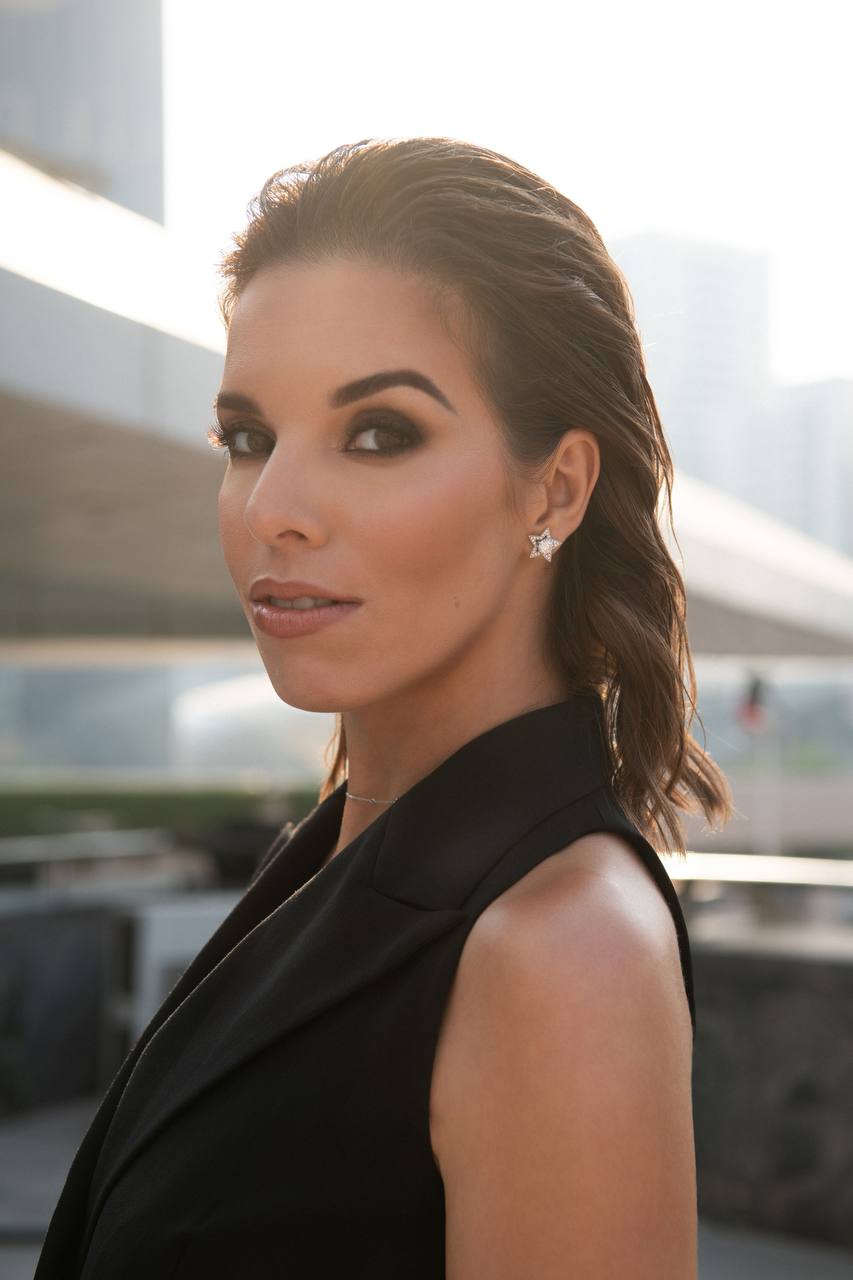

Genia Xasis, CEO and co-founder at female VC and tech founder community Berkana.VC and MENA investor relations expert, tells us how to avoid the mistakes that first-time entrepreneurs make while fundraising.

Reaching out to investors for the first time? As someone who helps startups with early-stage fundraising in the Middle East, I can’t think of a single founder who nailed investor pitching from the first try. In fact, only 1% of pitch decks result in funding.

Having seen the good, bad, and ugly, I’ve outlined 5 typical mistakes first-time entrepreneurs make when reaching out to investors.

1. Not Finding the Right Investor

The first pitfall awaits at the start. I see many entrepreneurs “spray and pray,” pitching any VC they can find. This often leads to the first mistake–overlooking the investment focus. Ignoring the gap between what you do and what investors fund is the number one error you can make.

Investment focus builds on the following factors:

- Investment type (angel, venture funds, high-net-worth individuals, family offices).

- Investment stage (seed, Series A, etc.).

- Average check.

- Location (or geo-agnostic).

- Tech focus (deeptech, AI, impact, blockchain, etc.)

- Cashflow status (pre-revenue, generating revenue).

- Ability to lead the round.

If a project does not match the investment focus, pitching can be a waste of time and effort. Moreover, it can affect your business reputation in the long term.

How to avoid missing the focus:

Pick your investors and study their investment focuses closely, using information from open sources such as Crunchbase or Pitchbook. If publicly available data is limited, reach out to an employee or an investor directly on LinkedIn. Ask what they are looking for in a startup to make an investment decision, and ensure your profile matches before proceeding to a pitch.

2. Pick Your Battles

Once they make the first mistake, entrepreneurs often end up chasing irrelevant investors. For example, a seed-stage startup is trying to pitch a fund focused on the growth stage. A founder asks for a smaller check right now, on the premise of expected growth and the promise to come back for a full-size investment later.

While these cases may make a media splash, approaching investors just to “put a foot in the door” is risky and not worth alienating potential supporters.

How to avoid reaching out to irrelevant investors:

If you’ve met an investor, but your business is too small for them, add them to your CRM. Structure your database, mark the stage each investor focuses on, and maintain a connection by networking and sharing company updates. Then pitch at the right time when you match their investment focus.

3. Learn to Navigate Cold Outreach

Quality cold outreach (pitching to investors you haven’t met or haven’t been introduced to) is crucial for building long-term relationships. But it’s hard. According to an HBR survey, cold outreach accounts for just 10% of deals. And nothing is more frustrating than a sales-y and impersonal cold outreach looking as if it’s been sent to at least a hundred other VCs.

As an angel investor, I receive lots of messages saying to “invest right now, last chance to jump in” every day. But founders forget that there is a human behind every LinkedIn page who deserves respect. Even cold outreach needs a personalized approach and good reasons for a VC to support your business.

How to avoid being annoying with cold outreach:

Plan your cold outreach with mutual benefit in mind. Talk about value exchange and how you can achieve a win-win from your partnership. Show interest. Offer help. Follow them on LinkedIn and react to posts and messages. Suggest jumping on a call. Share some cool analytics. Even though cold pitching is often virtual, the rules remain the same as if you were to meet someone in person.

When moving onto an actual pitch, emphasize how you can solve this person’s problem. Remember–your goal is to nurture relationships and turn a cold contact into a warm one.

4. Nail your Pitch Deck

If you run a tech startup, your first impulse is to tell everyone (investors included) how amazing your product or technology is. While there is nothing wrong with communicating your USP, a key investor outreach mistake is selling the product rather than its shareholder value.

With little to no experience talking to investors, first-time founders often misjudge what investors do. Investors fund a (potentially) money-making project with a growing valuation. And they expect business results and a return on investment.

Certainly, R&D can influence a valuation, but pure development excellence is not enough. According to a study by TechCrunch, only a quarter of 320 pitch decks they analyzed had financials in them–and none of the startups that failed to secure funding included financials in their decks.

How to avoid selling the wrong proposition:

When crafting a pitch deck, sell your business and its money-generating potential as an asset for investors. Focus your pitch story on business, and use product development as a way to support your go-to-market strategy. Here’s a quick idea: We’re raising X round at Y valuation, and in Z years we’ll start generating revenue.

5. Master the Interview

Got yourself an interview with a potential investor? Congratulations–now make sure you don’t fall into the trap of selling yourself at all costs rather than seeking a mutually beneficial relationship.

On a hunt for funding, first-time entrepreneurs sometimes forget that a partnership with an investor does not end with writing a check. You’re in it for the long run, and not researching investors’ motives, previous partnerships, roles in funded businesses, expertise, and the help they can provide may lead to frictions in the future.

How to avoid a mismatch:

Here, I’d allow myself to draw an analogy with job hunting. It’s important not to fill a role, but to find the right role for you. While your main task is to sell yourself to an employer, you also need to “buy” the role with the right perks.

Carefully and tactfully, ask potential investors about their approach to working with portfolio startups. How did their relationships develop? How do they envision the collaboration? How engaged will they be in day-to-day operations? It’s better to ask those questions early to manage expectations from both sides.

Finally, if you make a move with investor outreach and it doesn’t pan out, it’s still experience gained. As an entrepreneur, remember: You’re in for a marathon, not a sprint.