How to Examine Your Company’s Cash Flows: Three Critical Steps for Sustainable Growth

In the world of entrepreneurship, we often hear stories of companies reporting huge paper profits, only to fail and declare bankruptcy in the end. This puzzling contradiction lies in the fundamental difference between accounting profit and actual cash flow. Not every number that “shines” on the income statement represents real cash in the treasury—it may just be an accounting figure.

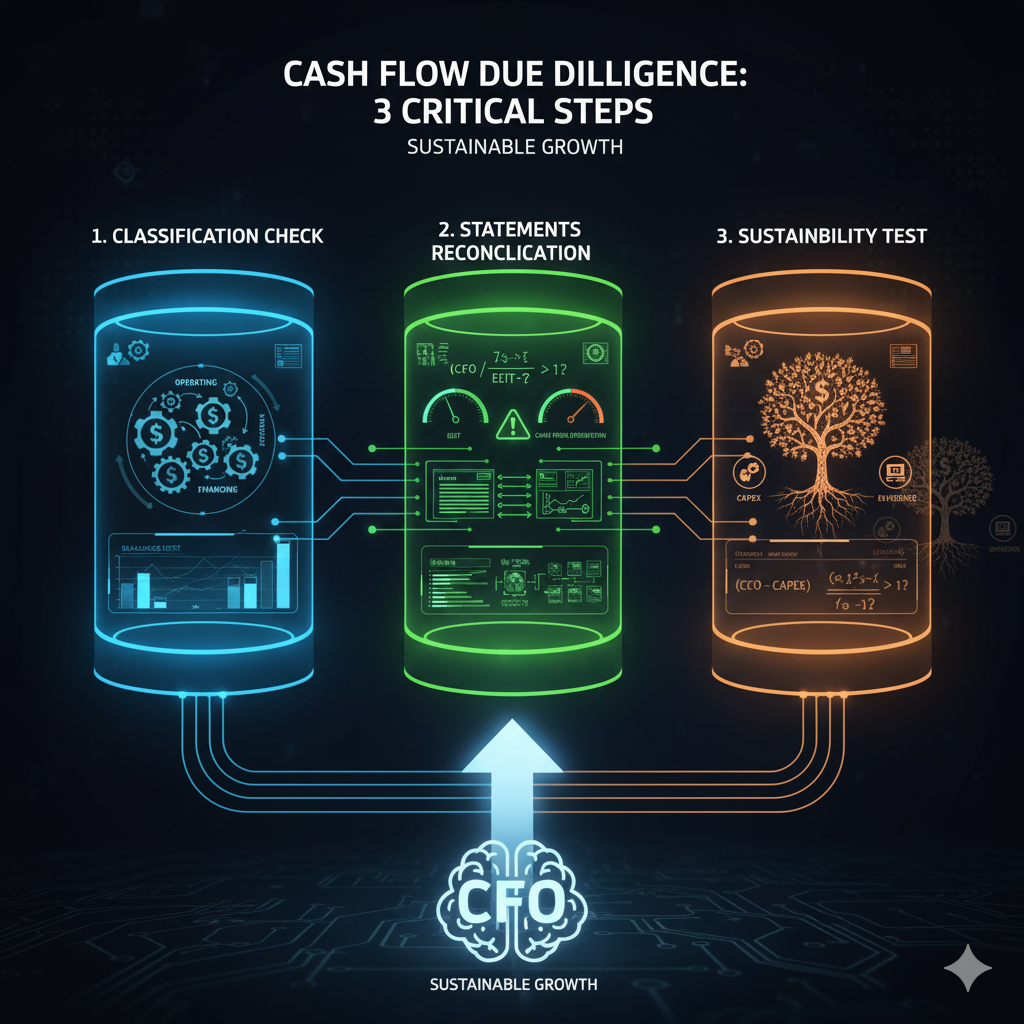

Understanding the movement of money in your company is not just an accountant’s task—it is a strategic mindset every entrepreneur must adopt. To effectively analyze cash flows, three essential steps protect you from being misled by numbers:

1. Categorization: Understand the Source of Cash

Cash is not a single entity; it comes from three main sources:

-

Operating Cash Flows: Generated from the core business activities (sales and services).

-

Investing Cash Flows: Arise from buying or selling assets (like property or equipment).

-

Financing Cash Flows: Come from issuing debt or equity.

A company’s financial health is measured by its ability to generate cash from operating activities. If net cash growth relies mainly on debt or asset sales, it indicates the core business model is not generating sufficient value, and long-term challenges may arise.

Example: Before the adoption of IFRS 16, lease payments were classified as operating expenses, reducing operating cash flow. After the standard, these payments are treated as debt, which can give a misleading impression of higher operating cash flows. This highlights the importance of understanding cash classification.

2. Linking Financial Statements: Look for Discrepancies

The cash flow statement does not operate in isolation—it must be interpreted alongside other financial statements. If your operating profit (EBIT) is high while operating cash flow (CFO) is low, this is a strong red flag.

This discrepancy often indicates that the company made significant sales but couldn’t collect the cash. This can lead to accumulating accounts receivable and put pressure on liquidity. To ensure profits translate into real cash, you can use a simple ratio:

Operating Cash Flow÷EBITtext{Operating Cash Flow} div text{EBIT}Operating Cash Flow÷EBIT

If this ratio is consistently below 1, it requires immediate review.

Example: “TechWave” in the UAE, a startup in tech solutions, signs a large government contract. Profits are recorded immediately in the income statement, but cash from the contract isn’t received for 90 days. While profits appear high, operating cash flow is low, which could trigger a liquidity crisis if not managed properly.

3. Sustainability Test: Assess the Ability to Continue

The final and most important step is asking: Does the cash generated from operations cover my key financial obligations?

-

Capital Expenditures (CAPEX): Is cash sufficient to buy equipment or expand?

-

Debt Repayment: Can the company service its debt?

-

Dividends: Can it distribute profits to shareholders?

If the company depends on continuous borrowing to fund basic investments or repay debts, the model is unsustainable. True cash generation is reflected in the ability to fund growth and obligations solely from operational activities.

Example: “Souqi Al-Arabi,” an e-commerce platform in Saudi Arabia, plans to expand by opening new warehouses. Instead of funding this expansion from potentially insufficient operating cash, the company takes a large bank loan. While this accelerates growth, it adds financial pressure that may affect long-term sustainability if operating cash flow doesn’t cover debt service.

Conclusion

Understanding cash flow is the most critical skill an entrepreneur can have. While profits may sometimes deceive, cash never lies. Categorization, linkage, and sustainability form the essential triad that protects your business from misleading numbers and ensures the potential for sustainable growth. This is the mindset every financial leader must adopt.