Venture capitalists have long focused on Silicon Valley and China – the two innovation powerhouses in most people’s minds. But while the world obsesses over the ups and downs of Big Tech and Chinese giants, India has been quietly pulling off an economic miracle. The country has already surpassed China in the number of startups and unicorns, and when it comes to tech investment growth, only the U.S. is ahead.

According to Venture Intelligence, venture funding in India hit $25.7 billion in 2023 — almost double the 2019 figure. Growth may slow in 2024, but the numbers are still impressive. The startup count has crossed 100,000, and India now has over 100 unicorns. This puts the country in second place globally — yet oddly, it still flies under the radar of the global conversation.

When Lagging Becomes a Competitive Edge

Just ten years ago, India’s startup ecosystem looked very different. Investors were cautious, put off by bureaucratic hurdles, limited capital, and low levels of digital infrastructure.

Looking back, 2016 was a turning point. That’s when the government launched the Startup India initiative, and Jio made mobile internet affordable for hundreds of millions. Digital payments through UPI (Unified Payments Interface) soon replaced cash, and both banks and regulators jumped on the fintech bandwagon. It was a rare case where being behind actually helped. Unlike developed markets locked into legacy infrastructure, India got the chance to build a digital economy from scratch — skipping the intermediate stages that the U.S. and Europe had to go through.

If someone had predicted in 2014 that India would become a global startup hub, most people would have laughed. But today, companies like Byju’s, Ola, Swiggy, Zerodha, and Dream11 aren’t just local success stories — they’re global players with tens or even hundreds of millions of users.

India’s biggest advantage? Its market and demographics. With 1.4 billion people and one of the youngest populations in the world (average age: 28), the country is a fertile ground for tech innovation. Unlike China, where growing state control is stifling the venture scene, India remains open to foreign capital, with relatively flexible regulations. Its strong IT sector – which has long supplied engineers to Google, Microsoft, and Amazon – is now increasingly focused on building for India itself.

India’s booming consumer base — over 800 million internet users — is fueling demand for edtech, e-commerce, delivery services, fintech, and telemedicine. It’s a perfect testing ground for new business models.

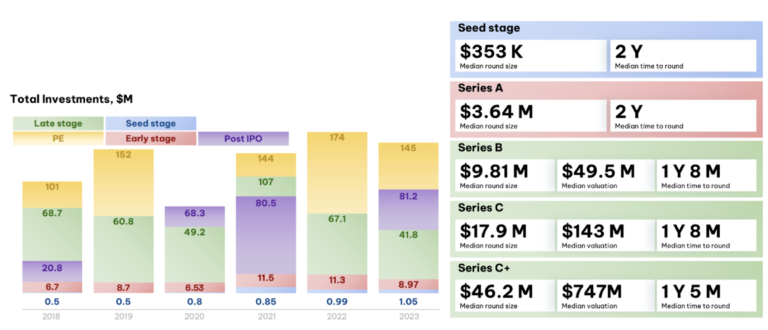

Venture investment by round and year, India 2018–2023. Source: Blank, Tracxn data

A Hot Market for Global Investors

Naturally, global investors have taken notice. In recent years, heavyweights like Sequoia Capital, SoftBank, and Google have poured billions into Indian startups. Given the market size and the agility of Indian companies, it makes sense. Fintech, in particular, has been a major growth engine, providing banking access to millions previously excluded from the traditional financial system.

The Tough Reality for Founders

Still, for all its promise, India remains a tough nut to crack. Entrepreneurs and investors alike run into a tangle of challenges typical of the local business landscape.

The biggest headache? Bureaucracy. Setting up a company, getting licenses, and sorting out taxes can be a long and costly ordeal. Founders often need to hire legal and financial pros early on, which drives up expenses at a time when every rupee counts. You also have to navigate a maze of local tax laws and state-level regulations that vary across the country.

Funding is another hurdle. While local VC activity has grown, India’s seed rounds are still small by global standards — with a median size of just $353,000, far below what you’d see in the U.S. or Europe. Indian investors tend to back more mature companies where the risk is lower, rather than go unicorn-hunting among early-stage startups.

Startups based outside major tech hubs like Bangalore and Mumbai face even more isolation, with limited access to the venture ecosystem concentrated in those cities.

Then there’s the consumer challenge. Indian customers are price-sensitive and cautious about adopting new products. That means startups have to work extra hard to prove their value — investing heavily in marketing and localization. If you’re entering a space where big conglomerates or global giants already play, get ready for a fight. Traditional players can quickly copy innovations and roll them out under their brand, often with more aggressive pricing.

Looking Ahead

Despite the challenges, India’s venture future looks bright. By 2030, it could match China’s total VC investment. The number of billion-dollar tech companies could double. As China’s economy cools, India is shaping up to be the only real alternative to Silicon Valley.

India’s venture ecosystem is a paradox: where obstacles often become catalysts for innovation. And maybe that’s what sets it apart – the ability to turn constraints into opportunity. That spirit could well define India’s role in the global startup scene in the years ahead.

India is fast becoming one of the world’s most dynamic venture markets. Over the past decade, it has taken a massive leap in tech, entrepreneurship, and investment appeal. The real question now is – can it sustain this momentum and keep growing amid global economic uncertainty?