Once known for its vast oil reserves, Saudi Arabia is quickly becoming a hub for innovation and entrepreneurship. This transformation is driven by the ambitious Vision 2030 plan, which aims to diversify the economy and advance technological progress.

The history of venture business in Saudi Arabia is a story of strategic evolution. Introduced in 2021, the Vision 2030 strategy aims to increase the private sector’s contribution to GDP to 65% and raise direct foreign investments to 5.7% of GDP by 2030. This ambitious strategy has laid the groundwork for a surge in investments across various sectors, from entertainment and tourism to futuristic “giga-projects” like NEOM–a $1.5 trillion infrastructure plan.

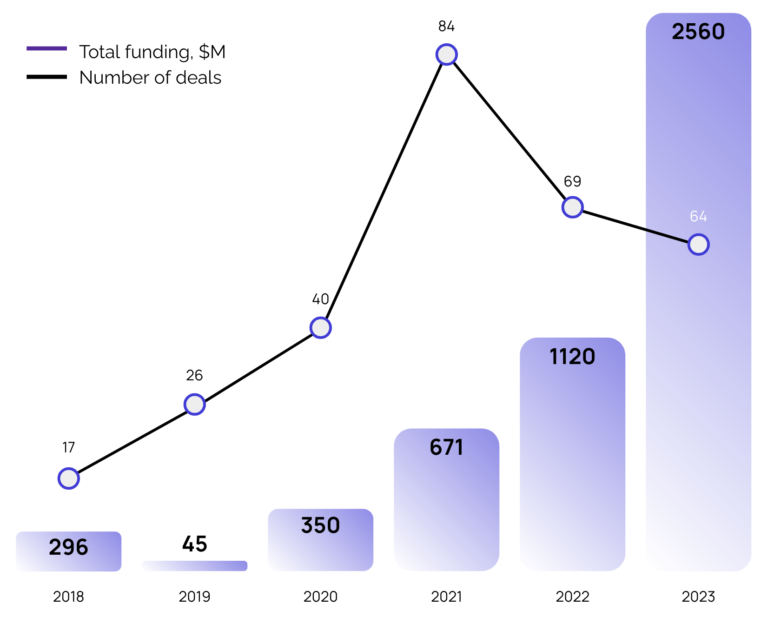

Four years ago, the volume of venture deals in Saudi Arabia was $45 million. Today, it exceeds $2.5 billion. The country is home to about 200 venture funds–still far fewer than in the UAE, but an order of magnitude more than a few years ago. Since 2019, the volume of venture investments in Saudi Arabia has steadily grown, surpassing the billion-dollar mark for the second consecutive year.

Several mega-deals in fintech and e-commerce, each over $100 million, have contributed to this growth, including two investments in the last quarter that propelled the BNPL service Tabby and fintech startup Tamara to unicorn status. In fact, two out of the three companies that achieved unicorn status in the region last year came from Saudi Arabia.

Venture investments volume in Saudi Arabia, 2018-2023: $M

Source: Calculations conducted by the author, utilizing venture data from Tracxn and Pitchbook.

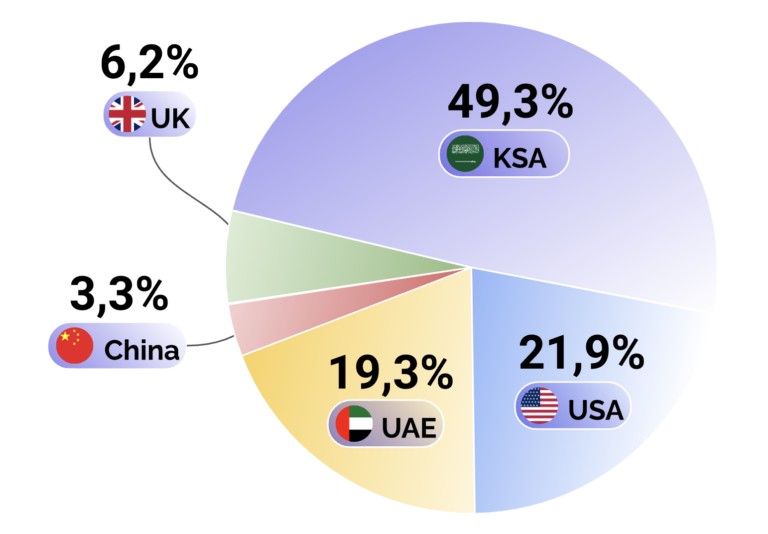

As a result, Saudi Arabia has become a leading destination for venture capital in the MENA market, surpassing its main competitor, the UAE, for the first time. Furthermore, it is the only country in MENA that has shown venture market growth in 2023, while its neighbors have seen declines of 10-30%.

Inflow venture investments by country, 2023, %

Source: Calculations conducted by the author, utilizing venture data from Tracxn and Pitchbook.

Local funds are the main source of startup capital, accounting for 49% in 2023, followed by American and Emirati funds. Overall, foreign investors from further afield have been investing less in Saudi Arabia in recent years, primarily due to the “venture winter” and a shift in priorities, preferring to minimize risks.

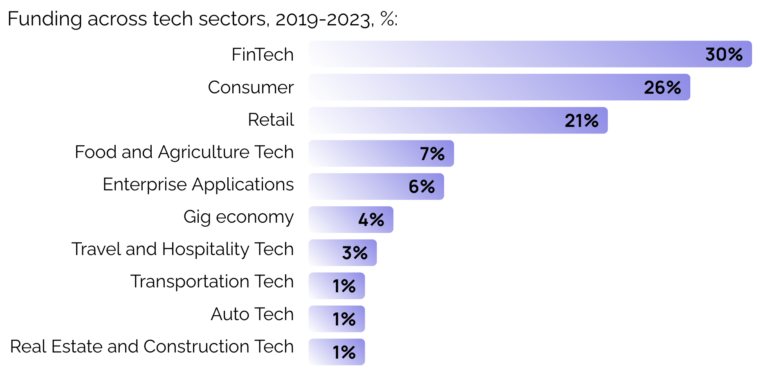

Funding across tech sectors in Saudi Arabia, 2019-2023, %

Source: Calculations conducted by the author, utilizing venture data from Tracxn and Pitchbook.

Fintech leads both in funding volumes and the total number of deals. Currently, there are three unicorn startups in the country, all in the financial sector: Tamara, Tabby, and STC Pay. Looking back, this sector accounts for 30% of all startup financing in Saudi Arabia and 37% in 2023.

Despite the promising opportunities Saudi Arabia presents, entering the market can also be challenging. And one of the most challenging aspects of setting up a new venture is opening a bank account. Additionally, an incomplete understanding of the business expansion process and securing suitable residential real estate for the team are significant hurdles.

Family relocation is also a considerable issue, with 65% of businesses reporting difficulties in smoothly relocating families. Many companies see the need for third-party assistance to ease this transition. Additional challenges include navigating regulatory requirements, understanding local consumer preferences, and maintaining compliance with labor laws, all while ensuring seamless integration into the local business ecosystem. Almost 90% of companies lacked or had limited knowledge of Saudi’s Special Economic Zones (SEZ), with only 12.6% of companies showing a strong understanding of the kingdom’s SEZs.

For startups considering Saudi Arabia as a potential base, understanding and leveraging the nuances of the local business environment is crucial.

First, the special economic zones in Saudi Arabia are key areas of opportunity, offering substantial incentives such as reduced taxation and streamlined procedures for obtaining visas and licenses. These benefits can significantly lower the barriers to entry and reduce operational costs, which is especially beneficial for nascent and expanding businesses. Additionally, the kingdom’s experimental legal frameworks allow startups to explore and test new ideas and technologies without the full burden of standard regulatory compliance. This can minimize risk and hasten the time it takes to bring products to market.

Second, connecting with local venture funds and accelerators is essential. The rapid increase in the number of both venture and government-backed funds enhances access to capital. Founders can effectively build their networks and approach investments by participating in various accelerator programs, such as Techstars Accelerator, Falak Business Hub, and TAQADAM.

In conclusion, achieving success in Saudi Arabia depends not just on understanding the legal frameworks but also on being adaptable to the swiftly evolving economic and cultural landscape. Strategic efforts to attract investments and develop infrastructure position the kingdom as one of the world’s most promising markets for innovative companies.