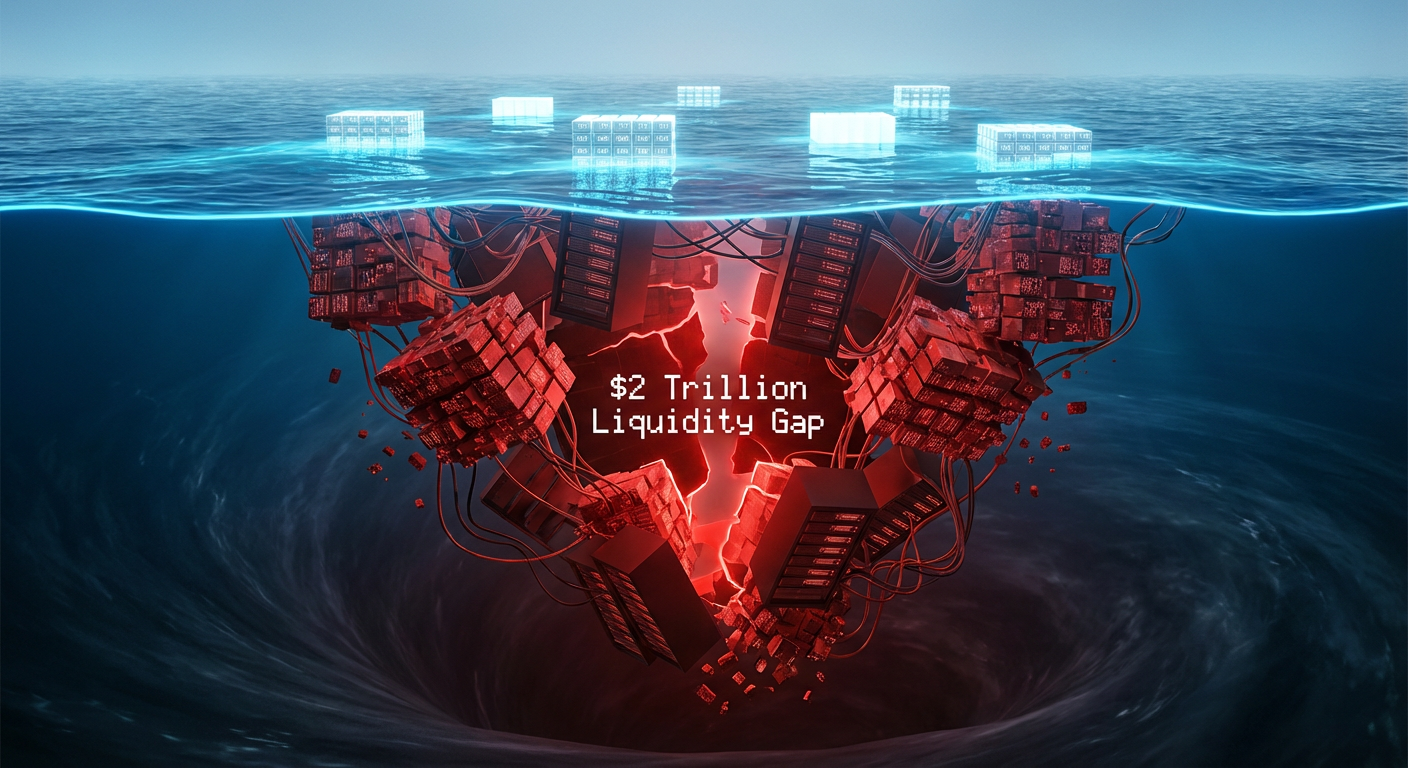

The $2.1 Trillion Data Hemorrhage

Numbers That Define the Hemorrhage

- $2.1 Trillion: Annual global economic loss due to corrupted data.

- $900 Million: Instant capital loss from a single “fat finger” error at a Tier-1 bank.

- 417%: Year-over-year increase in regulatory penalties for data governance failures.

- 0.05 Seconds: The time it takes a data error to compromise an entire trading desk.

The Moment Capital Evaporates

It happened at 3:47 PM on an ordinary Tuesday. A single line in an email: “Balance discrepancy: $847 million.”

The CFO read it twice. By Thursday, the stock had collapsed 34%. Auditors discovered that a “seamless” system migration had swallowed 40% of the inventory data. The assets were not stolen, they simply ceased to exist in the digital ledger.

Factories halted. Supply chains froze. Moreover, nearly a billion dollars in working capital vanished.

This is not a technical glitch. It is a solvency crisis. For decades, we have poured billions into “Digital Transformation” cloud architectures, AI directors, and real-time analytics. Yet, beneath the shiny dashboard, the engine is misfiring. We are witnessing the largest wealth transfer in corporate history, not to hackers or competitors, but to Data Rot.

The Global Dossier: Three Case Studies in Failure

We often dismiss data errors as administrative nuisances. The following cases demonstrate they are, in fact, existential threats.

- The Phantom Inventory (Retail)

A major retail chain celebrated a system migration that came in under budget. The hidden cost? A 0.3% algorithm error in product coding.

- The Impact: The system reported abundant stock in Chicago while Dallas shelves sat empty.

- The Cost: The company burned $200 million in emergency credit to cover a shortage that existed only in their database. They were optimizing for a reality that did not exist.

- The Rogue Algorithm (High-Frequency Trading)

A mid-sized firm’s algorithm, feeding on eight data streams, encountered a 0.05-second timestamp lag from one vendor.

- The Impact: The algorithm interpreted the lag as a pricing arbitrage opportunity. It bought high and sold low, 4.3 million times in 11 minutes.

- The Cost: $187 million lost before the kill switch was hit. The SEC added an $18 million fine, not for the loss, but for the lack of data governance.

- The Frozen Settlement (Global Payments)

A processor handling $3 trillion annually found that 0.02% of transaction records carried corrupted legacy identifiers.

- The Impact: $600 million in merchant funds froze instantly.

- The Cost: A $2.1 billion erasure of market cap as investors realized the firm’s “unbreakable” settlement engine was built on fractured pillars.

The Governance Gap: Who Owns the Truth?

Why does this persist? Because in most Fortune 500 companies, data quality falls into a bureaucratic void.

Ask IT, and they say the pipes are working. Ask the Business Unit, and they say they trusted the dashboard. It is a problem without an owner. As a former Chief Risk Officer noted, “Every company is sitting on a time bomb of legacy systems. Data quality lights the fuse. The balance sheet is where it explodes.”

The Regulatory Pivot: Capital at Risk

The era of the “slap on the wrist” is over. Regulators are shifting tactics from fines to Capital Requirements.

- The New Reality: If your data quality is rated “D,” regulators may force you to park $500 million in non-working capital to offset the risk.

- The SEC Stance: The 2025 examination priorities are clear: Data governance failures are now viewed as safety and soundness violations. Your data hygiene is now as critical as your liquidity ratio.

The Executive Playbook: From Liability to Asset

The “Hidden Liquidity Crisis” is only hidden if you choose to close your eyes. Winning organizations are not spending more, they are spending with precision.

Here is the Strategic Response for the empowered Board:

Phase 1: The Audit

Stop guessing. Commission an independent audit of your top 10 financial data flows. Do not ask for uptime metrics; ask for accuracy metrics. If you cannot certify the data, you cannot certify the financial statement.

Phase 2: The Incentive Shift

Data quality is no longer an IT ticket; it is a KPI. Assign ownership of data domains (Payments, Inventory, Risk) to specific executives. Tie 15% of their variable compensation to data integrity scores. When the Head of Payments knows that bad data impacts their bonus, the data gets clean.

Phase 3: The Capital Reallocation

Redirect 20% of your “Digital Transformation” budget toward “Data Assurance.” Require a “Data Quality Certification” before any new system goes live. No exceptions.

The Verdict

You have built a Ferrari. You have the horsepower, the AI, and the talent. However, if the fuel (your data) is contaminated, the engine will stall.

The $2.1 trillion cost of bad data is a tax on the unprepared. But for the leader who takes control, it is an opportunity. By fixing the plumbing, you don’t just stop the leak, you unlock liquidity your competitors are still losing.