From Cost-Cutters to Value Architects: The New Mandate for MENA Finance Leaders

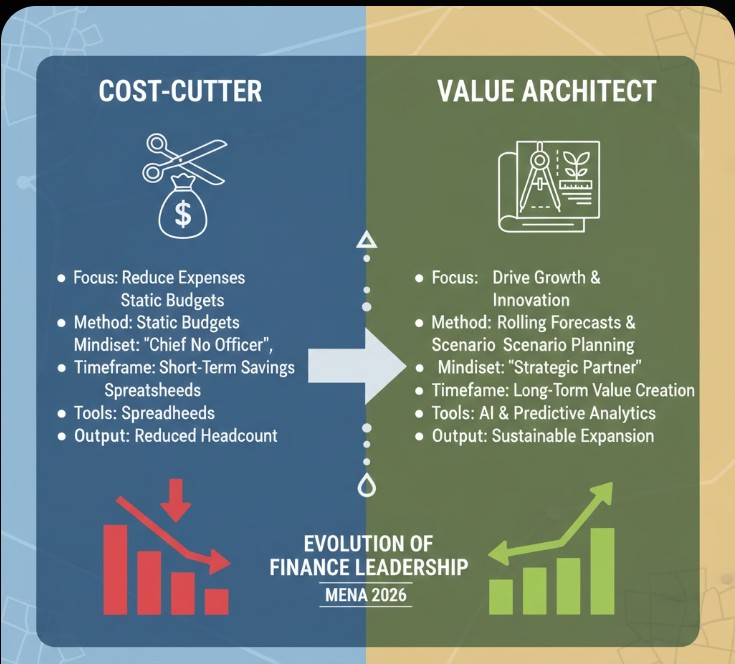

In the traditional boardroom, the CFO or Finance Director was often viewed as the “Chief No Officer”—the guardian of the budget whose primary tool was the red pen. However, as the Middle East undergoes a historic economic transformation, from Saudi Arabia’s Vision 2030 to the UAE’s “We the UAE 2031,” the role of finance has shifted.

In 2026, the most successful leaders are no longer just managing balance sheets; they are Value Architects.

The Death of Traditional Budgeting

The era of “static budgeting” is over. In a region characterized by rapid gigaproject development and fluctuating global energy markets, waiting for a quarterly review to adjust strategy is a recipe for obsolescence.

Value Architects utilize “Rolling Forecasts” and scenario planning. They don’t just report on what happened; they use predictive analytics to show what could happen. For a startup in Riyadh or an established firm in Cairo, this agility is the difference between scaling and stalling.

Beyond the Bottom Line: Strategic Capital Allocation

A “Cost-Cutter” looks at an expense report and asks, “How can we reduce this by 10%?” A “Value Architect” looks at the same report and asks, “Is this dollar working hard enough to fuel our long-term strategy?”

-

Investing in Intangibles: Modern value creation lies in data, brand equity, and human capital. Real-world leaders in the region are now prioritizing “Digital Capex”—investing in AI-driven financial models that provide real-time visibility into unit economics.

-

The ROI of Sustainability: With the MENA region’s increasing focus on ESG (Environmental, Social, and Governance), finance leaders are now quantifying the “Green Premium.” It’s no longer just about compliance; it’s about accessing cheaper capital and winning the loyalty of a conscious generation of Arab consumers.

Bridging the Gap: Finance as a Business Partner

The most significant shift is cultural. A Value Architect breaks the silos between the finance department and the rest of the organization.

-

Real-World Example: Consider the rise of FinTech unicorns in the region. Their success isn’t just due to clever code, but to finance teams that act as “Strategic Partners,” helping product teams understand customer lifetime value (CLV) and burn rates in real-time, rather than at the end of the month.

The Human Element in Numbers

As we integrate AI into our financial workflows, the “Human Touch” becomes the ultimate differentiator (as discussed in our previous exploration). The Value Architect uses AI to handle the IFRS reconciliations and data entry, freeing up their time to provide what the machine cannot: Judgment.

“Price is what you pay; value is what you get.” — Warren Buffett

Closing Thoughts for Entrepreneurs

To lead in today’s economy, you must stop viewing finance as a “back-office” function. It is the very engine of strategy. Whether you are a founder preparing for a Seed round or a Director at a multinational, your goal is the same: move beyond counting value to actively architecting it.